Onome Amuge

The Central Bank of Nigeria (CBN) has opted to maintain its benchmark Monetary Policy Rate (MPR) at 27.5 per cent, a decision that aligns with a broad consensus among analysts and market observers. The announcement followed the latest meeting of the Monetary Policy Committee (MPC), concluding its 300th session today, May 20, 2025.

The decision to hold rates comes as Nigeria observes a marginal easing in its inflation rate, which decelerated to 23.71 per cent in April, according to data released by the National Bureau of Statistics (NBS). This marks a sign of cooling after a period of aggressive monetary tightening by the central bank.

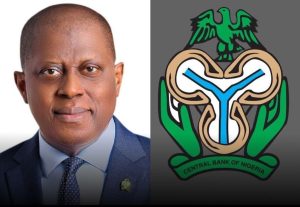

CBN Governor Olayemi Cardoso, addressing the press at the conclusion of the two-day MPC meeting, confirmed that all twelve members of the committee unanimously voted to retain the current monetary policy stance.

The MPC’s deliberations, which included a comprehensive review of both domestic and global macroeconomic developments, led to the following key policy decisions:

- Monetary Policy Rate (MPR): The rate was retained at 27.50 per cent. This move is intended to sustain the current disinflationary stance and anchor inflation expectations, indicating the CBN’s continued commitment to price stability.

- Asymmetric Corridor: The corridor around the MPR was maintained at +500 / -100 basis points. This framework aims to provide the central bank with flexibility in managing monetary policy while simultaneously curbing excess liquidity within the banking system.

- Cash Reserve Ratio (CRR): The CRR for Deposit Money Banks (DMBs) was held steady at 50 per cent, with Merchant Banks retaining a 16 per cent CRR. These levels are consistent with the CBN’s ongoing efforts to manage the money supply and contribute to the stabilisation of the naira.

- Liquidity Ratio: This ratio was kept constant at 30 per cent. The decision is expected to support financial system stability and ensures adequate resilience across the banking sector.